Would you pay $300 for a pair of jeans? What if they were by a popular designer and all the rage?

Personally, I couldn’t fathom paying that much for a pair of jeans. But a beautiful pair of shoes or a gorgeous handbag, well…

Or, what about something a bit more mundane like laundry detergent? Which one do you use? (Me: Tide) Why do you prefer your particular brand? (Me: it’s what my mother used when I was growing up).

Just as I do, you have parameters for how much you will pay for the products and services you buy. Also like me, you have brand loyalty as well as preferences of the vendors from whom you buy. On the surface, this may all seem innocent.

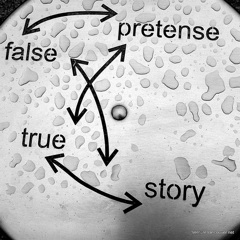

But behind every purchase lurks an interesting story about the real reason you buy what you buy, when, why, and from whom.

Sometimes that “story” tells you you absolutely need/ed what you are about to buy or just purchased.

Sometimes that “story” convinces you that you aren’t spending money…you’re really making an investment.

Sometimes that “story” whispers in your ears not so pleasant words such as, “you don’t deserve that;” or “you can’t afford that!” (even though you really can); or, “fill in the blank with something negative.”

And then there are choices, both the choices you make and the choices available to you in the form of options. For the latter, one might even say we have too many. After all, do we really need 32 different types of toothpaste from one manufacturer?! With so many options (of anything), how do we determine what is right for us; what’s the criteria?

No wonder there’s a phenomenon called decision paralysis!

Once you consider the elements of the “story” coupled with the factors that influence your choices, you discover there’s no such thing as an “innocent” purchase.

Traditional economists peg you and me as “rational” buyers. To them, we approach our buying habits, preferences, and choices logically. Ha! (Just take a quick trip down memory lane and think about the purchase decisions you’ve made this week.)

Unlike traditional economists, behavioral economists recognize that our habits, preferences, and choices are steeped in emotion — steeped in unspoken, invisible sentiments that feed our sense of appeal, exclusivity, or sensibilities, just to name a few.

Which is why when you and I talk about money and do the work to become financial stewards, we must expand the dimensions we discuss. Far too often, we talk about money as if it is one dimensional. When in truth, it is a multi-dimensional, abstract, complex, and emotionally-driven utility.

That is why you need to get honest about your behavior with money (in a loving, compassionate way of course!) and become more aware of your unconscious motivations. This is a must if you want to be in the front leading and directing your money, rather than in front being pushed by your money. Same position; different posture; different experiences and outcomes.

p.s. if today’s post piqued your curiosity, you’ll love the free training I have coming your way soon. Keep an eye on your inbox (May 29th), for a video invitation to a special training event on this topic. Not on our mailing list? Click here to join!

p.p.s. are you on our Sneak Peek List? Become a “sneaky peeker” and be the first to know when I’ve got something new, sweet, and juicy to share.

Photo Credit: Flikr, Venture Vancouver