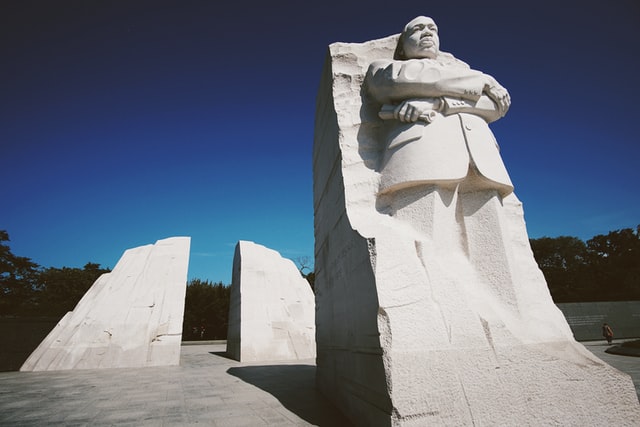

Friday, January 15 was the actual birthday of Dr. Martin Luther King, Jr. Tomorrow we celebrate it as a U.S. national holiday.

Today, I wonder what our country would look like if we had fulfilled his dream of economic justice.

What if we were really able to eradicate economic inequality and the bootstraps narrative that often goes with? You know, the one that says people’s financial well-being is exclusively tied to their effort – without any consideration of the roles and impact of the structures and systems within which they live. I’ve been thinking about this a lot.

Especially when you consider how 2020 put a magnifying glass on what has existed in plain sight for years – multiple generations, in fact – but evidently has not been comprehensively addressed.

Because that would require more people asking uncomfortable questions, taking uncomfortable actions and making uncomfortable changes.

And based on our collective history, I’m not so sure we’re really committed to that level of discomfort – despite the rhetoric that frequently says otherwise.

Dr. King stood for economic justice just as much as he did for social justice. But, as Prof. Douglas Thompson reminds us, “…we allow ourselves to see King dying for civil rights. He was in Memphis for economic justice.”

Investopedia notes economic justice as the “idea that the economy will be more successful if it is fairer.” Hold this thought for a moment…

In December 2020, the RAND Corporation released a Working Paper, “Trends in Income From 1975 to 2018.” The report raises the question, “What if incomes grew like GDP did?” You may find the answer their data uncovered as astounding as I did!

From the report, “income inequality has cost the bottom 90% of workers about $2.5 trillion.” Take away the widening difference between income and GDP – or income growth and economic growth – and a person working full-time earning $50,000 a year today would actually be earning approximately $92,000 today.

In other words, the income inequality is costing this worker about $42,000 a year.

Now compound that over several years. Kinda astonishing, right?

Not only do individuals and individual families lose out, unable to experience a higher standard of living. But so too does the economy, because it is stifled. There’s nothing fair about this.

And I suspect this isn’t quite the economic justice Dr. King had in mind.

In fact, his speeches inextricably tie the relationship between income growth and economic growth together – wanting both to increase.

But here’s an uncomfortable truth: The inverse relationship between income growth and economic growth isn’t accidental; it is a by-product of our laws and policies.

The Rise of Self-Help & Personal Finance

The RAND study covers a period starting in 1975.

Interestingly, this is also when the self-help movement became more mainstream. Followed a decade later by the growth in personal finance; this is when it became more main street.

Over the years, I’ve purchased and read my share of self-help books. (FYI: Self-help books are an $800 million industry (2016) according to Market Research.)

And in the late 80s, I saw first-hand the shift from defined-benefit plans to defined contribution plans and individual retirement accounts (IRA). All of which contributed to the huge growth of the mutual funds industry. To put this in context, in the 1970s, there were less than 500 mutual funds; by 1985, there were about 900 equity and fixed income funds; today, there are 7,945.

I also saw how the Community Reinvestment Act led to the explosion of financial literacy starting in the 80s. (If you know me, you know I hate the term “financial literacy.”)

There’s a question embedded in all the numbers and stats I’ve just shared.

It’s a question that’s been gnawing at me for sometime (ask a few of my friends).

And it’s a question, I’ll be noodling on some more as I celebrate the life, work and legacy of Dr. King. It’s this:

With the rise of the self-help and personal finance industries over the last 40 years, how is it that we have fewer rich and wealthy Americans?

As I mentioned above, 2020 laid bare many things. Including the reality that many people/families who did all the “right” things with their money still found themselves wanting, financially. (Think of the news coverage of middle-class families on food bank lines.)

To me, this is further proof that one’s financial well-being isn’t exclusively tied to how hard they work. And not only does it prove just how false the “bootstrap” narrative is, it also blinds us to the structural and systemic questions we should be asking – but aren’t!

I have lots of questions; I tend to always do. I don’t have any solid answers for them (yet). But I do have a request: On a scale of 0-5, with 5 being “often” and 0 “not at all:” How often do you think about economic growth? (You can share with me a DM on IG. :/)